Monday, January 31, 2011

Super Bowl parlay bet

Can't get to Vegas to bet on the Super Bowl? Then bet on Las Vegas Sands that has earnings on the 3rd. And then, take the money you make on that, and bet it with the neighborhood bookie taking the Packers and the over.

And after you cash the bet, tell your buddies you got the play from Marissa!

And after you cash the bet, tell your buddies you got the play from Marissa!

"What about Methanex?"

So check out Methanex--The plant in Egypt accounts for 60% of their earnings. Why didn't this stock get cut in half if the situation in Egypt was so dire???

So ask Bob Janjuah about that. If the company most directly affected by the situation in Egypt hasn't cracked--then why should the market?

What about it, Bob?

And if you don't want to read about that, read about metals and fertilizer!

Salman 013111 -

So ask Bob Janjuah about that. If the company most directly affected by the situation in Egypt hasn't cracked--then why should the market?

What about it, Bob?

And if you don't want to read about that, read about metals and fertilizer!

Salman 013111 -

Gartman: Looking for a 6% pullback

But the real read is the theft, by dictators, of the people's money!

For a subscription to the Gartman Letter, go here:

Gartman_013111 -

For a subscription to the Gartman Letter, go here:

Gartman_013111 -

Sunday, January 30, 2011

Oh My!!! The New York Times is worried....

Big Deal...

But here's what the Gray Lady has to say--which means it won't happen!!

NY Times

On Wall Street, it is what is known as an exogenous event — a sudden political or economic jolt that cannot be predicted or modeled but sends shockwaves rippling through global markets.

Shockwaves??? Oh My!!!

“But as is usually the case, a boxer never gets knocked out by a punch he’s looking for,” he said. “This could be what triggers the decline. Geopolitical events are very, very hard to model.”

Hard to model? Come on. Obama picked Vick and the Eagles; he then picked the Chicago Bears, and then he picked Mubarak. Which means, that despite Obama wanting to screw things up, the voice of the people will be heard.

And now, Bo will parrot the will of the people of Egypt!

So Wall Street will say that the unrest in Egypt will spread to Saudi Arabia, and what happened in Tunisia and Algeria will eventually spread around the world.

That's a daisy chain claim that will cost you money.

Because every hedge fund manager is now touting and hedging their portfolio.

Oh My!!

Egypt is Egypt. Their photoshoppers are as bad as China's.

And just like China showed Top Gun clips as evidence of their weaponry--only to be picked up by the Telegraph many days later after it has already happened; the folks at the NY Times have a forecasting record as good as these dictators have photoshoppers!

Oh My!!

But here's what the Gray Lady has to say--which means it won't happen!!

NY Times

On Wall Street, it is what is known as an exogenous event — a sudden political or economic jolt that cannot be predicted or modeled but sends shockwaves rippling through global markets.

Shockwaves??? Oh My!!!

“But as is usually the case, a boxer never gets knocked out by a punch he’s looking for,” he said. “This could be what triggers the decline. Geopolitical events are very, very hard to model.”

Hard to model? Come on. Obama picked Vick and the Eagles; he then picked the Chicago Bears, and then he picked Mubarak. Which means, that despite Obama wanting to screw things up, the voice of the people will be heard.

And now, Bo will parrot the will of the people of Egypt!

So Wall Street will say that the unrest in Egypt will spread to Saudi Arabia, and what happened in Tunisia and Algeria will eventually spread around the world.

That's a daisy chain claim that will cost you money.

Because every hedge fund manager is now touting and hedging their portfolio.

Oh My!!

Egypt is Egypt. Their photoshoppers are as bad as China's.

And just like China showed Top Gun clips as evidence of their weaponry--only to be picked up by the Telegraph many days later after it has already happened; the folks at the NY Times have a forecasting record as good as these dictators have photoshoppers!

Oh My!!

Charlie Sheen's rate for blow

Now you know why the porn star didn't stay to finish the job.

She went running to the bank to cash the check!! (maybe the teller could help out Charlie.--Look how she "verefied" the check!)

NYPost

"When I first saw him, he was just f--king wasted out of his mind, which I was trying to get to that point, too, trust me," Jordan gushed.

"I said, 'I can beat you, I'll beat you in drinking,' " she said. "And . . . he's like, 'Bull---t.' And I just made myself, like, an all-vodka drink . . . and he grabs it from my hand and . . . he chugs it in like three seconds.

"Don't ever -- don't ever test me again," he snapped, according to Jordan, who was given a $30,000 check from Sheen for hanging out at his home, according to Radar Online.

And that was just a warm-up.

She went running to the bank to cash the check!! (maybe the teller could help out Charlie.--Look how she "verefied" the check!)

NYPost

"When I first saw him, he was just f--king wasted out of his mind, which I was trying to get to that point, too, trust me," Jordan gushed.

"I said, 'I can beat you, I'll beat you in drinking,' " she said. "And . . . he's like, 'Bull---t.' And I just made myself, like, an all-vodka drink . . . and he grabs it from my hand and . . . he chugs it in like three seconds.

"Don't ever -- don't ever test me again," he snapped, according to Jordan, who was given a $30,000 check from Sheen for hanging out at his home, according to Radar Online.

And that was just a warm-up.

Saturday, January 29, 2011

The quote of the day in Egypt

"Before this day, I used to be one of many people who believe that the people have become dead. What I saw today is that the people are not dead. They have decided to burn their fear instead of burning themselves."

Friday, January 28, 2011

Thursday, January 27, 2011

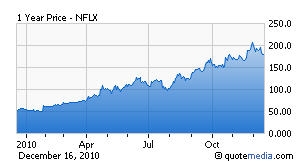

Goldman gets bullish on NFLX!!

Oh oh baby--the shorts will be running today!!

Remember all the doom and gloom on NFLX? Look at the chart--It gapped iup after the last earnings and just marked time, as the shorts laid into it.

This morning the shorts are paying. Goldman now thinks NFLX has room to run!!

And notice CAT this am? I said that congestion at 92-93 was just the springboard to 98. Well you got it.

And do you know watch chart NFLX looks like? How about LVS? And when they report earnings in two weeks, you'll have a move on this number, just like NFLX did.

Booyahhh Baby!!

Free money all over the place!!!!

gsjan27 -

And then, to top it off Citi gets bullish and behind the secular NFLX story too!

The only one missing from this story is Whitney Tilson? Remember him? He's the con artist that got all the shorts trapped in NFLX the last three months? Remember that?

Remember how Meredith "porky pig" Whitney spent 1000s of hours putting her junk piece together on municipal bonds? Well Whitney Tilson put together his junk piece on NFLX!

It's the no-nothing witlessWhitney's!

And in case you want to read it--read it here! Of course, this was AFTER this number already moved 100 points in his face!!

Once again, high paid, flatulence touted research!!

And then, remember when he was down 100 points on his NFLX short? He then goes on Seeking Alpha and touts his re-short at 178 of his short that's underwater!

Background

We've lost a lot of money betting against Netflix (NFLX), which is currently our largest bearish bet, in the form of both a short and put position. In this letter, we share our investment thesis in depth and describe why, at a stock price of $178.50 and a market cap of $9.3 billion (based on yesterday's close), we think it's an exceptional short idea.

Given the natural inclination to talk about winners and quietly sweep losers under the rug, one might ask why we are writing about one of our worst investments. We have three main reasons for doing so: First, we think it's healthy to disclose and fully analyze our mistakes (although in this case we are not yet conceding that we've made a mistake in our analysis, but we obviously made a mistake in terms of timing our entry into the position). Second, it's a useful exercise for us - it helps clarify our own thinking - to put in writing our investment thesis, especially on complex and controversial positions .....

Given the natural inclination to talk about winners and quietly sweep losers under the rug, one might ask why we are writing about one of our worst investments. We have three main reasons for doing so: First, we think it's healthy to disclose and fully analyze our mistakes (although in this case we are not yet conceding that we've made a mistake in our analysis, but we obviously made a mistake in terms of timing our entry into the position). Second, it's a useful exercise for us - it helps clarify our own thinking - to put in writing our investment thesis, especially on complex and controversial positions .....Complex my ass! It's just plain stupid!

Meredith Whitney wanted to crack municipal bonds to make a name for herself--and she didn't give a rat's ass on the old folks who panicked and sold bonds on her advice.

Whitney Tilson, wanted NFLX to crack so he could get a name for himself. He hated the fact that the CEO defended himself and the company. Well screw you Whitney. Do you think that Wall Street has a carte blanche to run over companies, just because you get short the name?

And for $10.59 a month---it's entertainment for the masses! Oh My! Let me take down NFLX! Give me a break!

And finally, for the haters out there--here is my tout of NFLX at 18. So go and #$* yourself!

---------------------------------

Friday, December 7, 2007

Citigroup "concerned" over NetFlix

Concerned? People are "concerned" about their children; analysts are "concerned" when 30% of the float is shorted, and the stock doesn't come in to the hedge funds who are short the stock. So we get a research fluff piece, with a sell recommendation that is picked up and disseminated by NY Times.

The Postal Service did an audit, and found that sometimes the adhesive flap causes the mail systems to jam, and thus the NetFlix mailer has to be sorted by hand. The Citigroup analyst said that 70% of all Netflix's envelopes did this. (He probably did "channel" checks at the post office.) The Postal service estimates this costs them over $21 million a year; and they would like .17 cent surcharge when the machines jam. (Netflix says they save the Post Office $100 million a year by picking up the returns instead of having them delivered by mail to them.) So the report said if Netflix "has to bear the full brunt of this increase (without other cost offsets), monthly operating income per paying subscriber would fall 67 percent from $1.05 to 35 cents."

And this is the "scary" headlines, with the sell recommendation that is pinged around the street, not the offsetting paragraph that says this: "Given the magnitude of this risk” Netflix is most likely to “work towards resolving this issue by redesigning its mailers." How about a stronger adhesive on the flap?

Which is how Wall Street works. There are always two sides of an issue, but Wall Street shows the cards they want, when they want the stock to move in the direction they favor.

And if you don't do, what they say to do, when the issue, which is not an issue, is made to be an issue, you'll be better off!

The Postal Service did an audit, and found that sometimes the adhesive flap causes the mail systems to jam, and thus the NetFlix mailer has to be sorted by hand. The Citigroup analyst said that 70% of all Netflix's envelopes did this. (He probably did "channel" checks at the post office.) The Postal service estimates this costs them over $21 million a year; and they would like .17 cent surcharge when the machines jam. (Netflix says they save the Post Office $100 million a year by picking up the returns instead of having them delivered by mail to them.) So the report said if Netflix "has to bear the full brunt of this increase (without other cost offsets), monthly operating income per paying subscriber would fall 67 percent from $1.05 to 35 cents."

And this is the "scary" headlines, with the sell recommendation that is pinged around the street, not the offsetting paragraph that says this: "Given the magnitude of this risk” Netflix is most likely to “work towards resolving this issue by redesigning its mailers." How about a stronger adhesive on the flap?

Which is how Wall Street works. There are always two sides of an issue, but Wall Street shows the cards they want, when they want the stock to move in the direction they favor.

And if you don't do, what they say to do, when the issue, which is not an issue, is made to be an issue, you'll be better off!

Japan gets downgraded and Soros piles on

So Japan gets downgraded to AA-

The downgrade reflects our appraisal that Japan’s government debt ratios–already among the highest for rated sovereigns–will continue to rise further than we envisaged before the global economic recession hit the country and will peak only in the mid-2020s. Specifically, we expect general government fiscal deficits to fall only modestly from an estimated 9.1% of GDP in fiscal 2010 (ending March 31, 2011) to 8.0% in fiscal 2013. In the medium term, we do not forecast the government achieving a primary balance before 2020 unless a significant fiscal consolidation program is implemented beforehand.

Japan’s debt dynamics are further depressed by persistent deflation.

And George Soros piles on regarding the UK's austerity plans since they printed a negative .5% GDP last week: “I don’t think they can be implemented without pushing the economy into a recession”

Remember last year at this time when Bloomberg was touting sovereign CDS spreads?

And Bill Gross tag teamed them with this opinion piece?

What does this mean? It just means that the hedge fund boys have laid out some bets, and they need to pimp some fear into the marketplace.

And they use Davos as their forum, and S&P as their pimp!

The downgrade reflects our appraisal that Japan’s government debt ratios–already among the highest for rated sovereigns–will continue to rise further than we envisaged before the global economic recession hit the country and will peak only in the mid-2020s. Specifically, we expect general government fiscal deficits to fall only modestly from an estimated 9.1% of GDP in fiscal 2010 (ending March 31, 2011) to 8.0% in fiscal 2013. In the medium term, we do not forecast the government achieving a primary balance before 2020 unless a significant fiscal consolidation program is implemented beforehand.

Japan’s debt dynamics are further depressed by persistent deflation.

And George Soros piles on regarding the UK's austerity plans since they printed a negative .5% GDP last week: “I don’t think they can be implemented without pushing the economy into a recession”

Remember last year at this time when Bloomberg was touting sovereign CDS spreads?

And Bill Gross tag teamed them with this opinion piece?

What does this mean? It just means that the hedge fund boys have laid out some bets, and they need to pimp some fear into the marketplace.

And they use Davos as their forum, and S&P as their pimp!

Wednesday, January 26, 2011

The "Oh My" crowd gets pasted!

Oh once again--just last week--we were told that AAPL was rolling over because of Steve Jobs had a medical leave. And then, GOOG was toast because Eric Schmidtt was leaving??? Give me a break!

The stock prices were wrong!

Along with everything else the bears come up with!

So someone says that I'm taking a victory lap with yesterday's post, and therefore this market will now go down?

Give me another break.

Wait--didn't I hear this before? How about every month since March of 2009!

And you want to know why the market isn't going down? Cause you haters still think it should!

Did anyone see the latest issue of Foreign Policy? Look at the bottom right hand corner. Wrong way Nouriel Roubini--as one of the greatest thinkers of 2010!! And he was completely wrong! And he was one of the greatest thinkers? And not 99, or 66, or 37--but he was ranked as number 12???

WTF??

Doesn't Foreign Policy read this blog? heck--I've been saying Roubini was a ZERO since March 9, of 2009. Yeh that Roubini!

With the vagina plasters of his co-ed conquests on his wall!

And that story was chronicled on this blog on April 30, 2009--where I said it was Dr. Roubini's last crack at fame.

How about a Booyah?

When college co-eds want to part their legs for a college professor for being bearish, that means you can short the good professor and the college co-eds! Unless of course, the good Dr. was parting with some of his money. Then, of course, that's just business as usual on Wall Street!

Yeh-so read it again, you idiotic morons at foreign policy who praise Roubini. You want to know why you can take free money in this market from all the bearish sheeple?

Because you have jokers like this in the press who don't do homework--just like bears don't do homework on the stocks they pick!!!

And now, you can make money in the real world, as easy as the money that you could make on Wall Street in 2009 and 2010.

I started a business that is returning 100% on invested capital monthly. Yes monthly. Each and every month. How long before the entrepreneurial spirits get awoken again, when you can get returns like this?

Well, just look back at Wall Street two years ago. What's happening now? People are finally starting to appreciate stocks again.

Well--gee you only had to have every household name in the country go up 200%, 300% or 400% for that to happen!

So that means, in the next couple of years, you'll see a boom in the entreprenurial cycle--because all those who prepared for Armageddon will now have to prepare for their own apocalypse unless they start making some money again.

So you bears that stupidly, think that you'll get bailed out of your losing positions? Well, I have a bit of advice from Forrest Gump:

And finally, what makes these bears think that people will just roll over and die, because they have hit a temporary stumbling block in life.

Do any of you bears really know about the fire that burns in the belly of a man?

Remember Team Hoyt?

A son asked his father, 'Dad, will you take part in a

marathon with me?' The father who, despite having a

heart condition, says 'Yes'. They went on to complete

the marathon together.

Father and son went on to join other marathons, the

father always saying 'Yes' to his son's request of

going through the race together.

One day, the son asked his father, 'Dad, let's join

the Iron man together.' To which, his father said 'Yes'

too.

When you bears can start telling me what is inside the heart of man, then, I'll start to listen to you.

Until then, I'll let Cramer speak on my behalf:

Tuesday, January 25, 2011

Do you want your news WHEN it happens or AFTER it happens??

So we had this post today--whereby Wall Street idiots are now, after the fact deemed idiots. Why didn't somebody call them on the carpet when they made their predictions? Oh that's right. Wall Street is too timid to have an opinion! But it was found one place. And it was found here. So it's nice to see that Wall Street, from 3 months to 23 months later, finally recognizes what I saw the day it happened!!

"During the last recession, the economy bottomed out in November 2001 and GDP growth was robust in 2002 but the U.S. stock markets kept on falling all the way through the first quarter of 2003. So not only were the stock markets not "forward looking," they actually lagged the economic recovery by 18 months--rather than lead it by six to nine months.

A similar scenario could occur this time around. The real economy sort of exits the recession some time in 2010, but deflationary forces keep a lid on the pricing power of corporations and their profit margins, and growth is so weak and anemic, that U.S. equities may--as in 2002--move sideways for most of 2010. A number of false bull starts would occur as economic recovery signals remain mixed.

Thus, most likely, we can brace ourselves for new lows on U.S. and global equities in the next 12 to 18 months."

--Nouriel Roubini on March 12, 2009

Dow: 7,170

Dow today: 11,971

So what was said here, then, about Roubini? And not 23 months later?

How about this:

So what. We go higher.

Roubini warned us that the Dow would hit 5,000.

http://www.freerepublic.com/focus/f-news/2202859/posts

So what. We go higher

Meredith Whitney warned us that we will have a $4.7 trillion contraction in credit card loans.

Whitney said available lines were reduced by nearly $500 billion in the fourth quarter of 2008 alone, and she estimates over $2 trillion of credit-card lines will be cut within 2009, and $2.7 trillion by the end of 2010.

http://www.reuters.com/article/newsOne/idUSTRE52921M20090310

So what. We go higher.

Trot her out on CNBC and let her pump the bear case.

So what. We go higher.

Another As Advertised!

"Stocks are very overvalued. Stocks peaked in September and are back in a bear market."

Of course Prechter, last fall, did the same thing, when we had the pullback in the market--So we had this, here, and then about Prechter's bearishness:

Another As Advertised!

And Rosenberg, Fleckenstein, Hussman, etc etc--and all you other bears? Well screw it--I have businesses to run!

Keep pontificating!

MARCH 2009: Nouriel Roubini predicts new lows in the next 18 months

"During the last recession, the economy bottomed out in November 2001 and GDP growth was robust in 2002 but the U.S. stock markets kept on falling all the way through the first quarter of 2003. So not only were the stock markets not "forward looking," they actually lagged the economic recovery by 18 months--rather than lead it by six to nine months.

A similar scenario could occur this time around. The real economy sort of exits the recession some time in 2010, but deflationary forces keep a lid on the pricing power of corporations and their profit margins, and growth is so weak and anemic, that U.S. equities may--as in 2002--move sideways for most of 2010. A number of false bull starts would occur as economic recovery signals remain mixed.

Thus, most likely, we can brace ourselves for new lows on U.S. and global equities in the next 12 to 18 months."

--Nouriel Roubini on March 12, 2009

Dow: 7,170

Dow today: 11,971

So what was said here, then, about Roubini? And not 23 months later?

How about this:

We go higher

I'd put another giant bull on the top of this piece, but you got that yesterday.

And you got a huge move in stocks!

This weekend, Barron's warned us about Dow 5,000.

If stocks do get to a P/E of 10, the S&P 500 could drop as low as 500, a decline of more than 25% from current levels, and the Dow Jones Industrial Average could drop toward 5000.

So what. We go higher.

Roubini warned us that the Dow would hit 5,000.

http://www.freerepublic.com/focus/f-news/2202859/posts

So what. We go higher

Meredith Whitney warned us that we will have a $4.7 trillion contraction in credit card loans.

Whitney said available lines were reduced by nearly $500 billion in the fourth quarter of 2008 alone, and she estimates over $2 trillion of credit-card lines will be cut within 2009, and $2.7 trillion by the end of 2010.

http://www.reuters.com/article/newsOne/idUSTRE52921M20090310

So what. We go higher.

Trot her out on CNBC and let her pump the bear case.

So what. We go higher.

Another As Advertised!

APRIL 2009: Dylan Ratigan says this is a suckers' rally, no question

Blodget: Last question. You've been right in the middle of this meltdown day after day, interviewing the smartest people, etc. So is this a new bull market, or is this another suckers' rally?

So what was said here, then, and not 22 months later about Ratigan?

How about this:

Today, a lot of people celebrate the resurrection.

Today, a lot of people celebrate the resurrection.

But not on Wall Street.

No-one believes in that resurrection; the one of the bull-market variety!

Check out the following quotes:

Ratigan: Suckers' rally. No question. That's not an indictment of the judgement of the market. That's just my perception of the ability of the banks to function in a timely fashion, the ability to create meaningful amounts of jobs in the immediate future, and the as-yet unrecognized meaningful losses to come in commercial real-estate and other asset classes...

http://www.businessinsider.com/henry-blodget-dylan-ratigan-speaks-and-hes-angry-2009-4

Ratigan: Suckers' rally. No question. That's not an indictment of the judgment of the market. That's just my perception of the ability of the banks to function in a timely fashion, the ability to create meaningful amounts of jobs in the immediate future, and the as-yet unrecognized meaningful losses to come in commercial real-estate and other asset classes

Dow: 8,083

Dow today: 11,971

So what was said here, then, and not 22 months later about Ratigan?

How about this:

Sunday, April 12, 2009

He is Risen!

Today, a lot of people celebrate the resurrection.

Today, a lot of people celebrate the resurrection.But not on Wall Street.

No-one believes in that resurrection; the one of the bull-market variety!

Check out the following quotes:

Ratigan: Suckers' rally. No question. That's not an indictment of the judgement of the market. That's just my perception of the ability of the banks to function in a timely fashion, the ability to create meaningful amounts of jobs in the immediate future, and the as-yet unrecognized meaningful losses to come in commercial real-estate and other asset classes...

http://www.businessinsider.com/henry-blodget-dylan-ratigan-speaks-and-hes-angry-2009-4

It's the question Pilate asked:

"What is truth?" John 18:38

Judging by the numbers of people going to church today, it appears that millions and millions believe in the resurrection.

Maybe Wall Street should learn from the masses.

A little bit of faith, makes the believing easy.

And it comes with it's own rewards!

Another As Advertised!

"I expect this risk rally to continue into – and maybe through – a large part of August. What happens after that? The next ugly leg of the bear market begins as we get into the July through September 'tipping zone', driven by the failure of the data to validate the V (shaped recovery) that is now fully priced into markets."

So what was said, here, then, about Janjuah and not 17 months later?

Another As Advertised!

"I believe that the markets are now overshooting to the upside and that the U.S. stock market has likely peaked for the year...

"What is truth?" John 18:38

Judging by the numbers of people going to church today, it appears that millions and millions believe in the resurrection.

Maybe Wall Street should learn from the masses.

A little bit of faith, makes the believing easy.

And it comes with it's own rewards!

Another As Advertised!

AUGUST 2009: Bob Janjuah says "The next ugly leg of the bear market begins as we get into the July through September 'tipping zone'"

"I expect this risk rally to continue into – and maybe through – a large part of August. What happens after that? The next ugly leg of the bear market begins as we get into the July through September 'tipping zone', driven by the failure of the data to validate the V (shaped recovery) that is now fully priced into markets."

-- Bob Janjuah on Aug. 12, 2009

Dow: 9,361

Dow today: 11,971

So what was said, here, then, about Janjuah and not 17 months later?

Sunday, August 16, 2009

What about Bob?

Bob Janjuah of RBS wants to be heard again, and of course, no better than to have another minister of bearishness, Ambrose Evans-Pritchard to bring it to our attention. From the Telegraph:

He expects global stock markets to test their March lows, and probably worse. The slide could last three months. "A move to new lows is highly likely," he said.

This time he expects the S&P 500 index of US equities to reach the "mid 500s", almost halving from current levels near 1000. Such a fall would take London's FTSE 100 to around 2,500. The iTraxx Crossover index measuring spreads on low-grade European debt will double to 1250.

This is just stupid talk, but because it's from an intellectual with an agenda, it will get press, even though the chance of it happening is less than zero. Bob's sailing out on the high seas!

Remember four days before the rally started he said, "Be Safe, Be a Survivor, and and Be Liquid" and then he pontificated that China would fall to 1500, and then, as in now, he said the S&P would fall to 500.

So if you didn't know who "Hitler" was yelling at in the video below, who sold stocks at the bottom, you now may have a better idea.

And if you didn't know who the fools were that said that this was just a "bear market rally" you may, now again, have a better idea.

Now remember just a few weeks ago, before this latest rally, how we had other uber bears warning us that the market was going to puke? With their Depression era charts?

And how about a couple months ago on option expiration in June? Remember Charles Biderman of Trim Tabs? Saying we were going to roll-over and die? In June, at option expiration "their" super strategic and highly confidential reports that cost you money (and that's the only thing they do--is they cost you money!) said they were now fully bearish on US stocks. Now less than two weeks after the market bottomed, Charles Biderman said on March at option expiration that the rally could be over. Over!! And expiration in March was going to kill the rally! (And really do these flows really matter? Didn't we have $60B outflow before the bottom, and now we have $57 B inflow--but do these flows measure the shorts that have leaned on stocks?)

It would sure be nice, if someone had a record of that, wouldn't it? Oh that's right. We do. Right here, when it happened.

Biderman said the really was over in March and then over in June--so now it's time to trot out a fresh face! So now we have bearish Bob!

So what's the difference between Biderman and Bob? It's just the same story, dressed up and spun just a little differently, but the only difference is, they think they can average up, and spin their stories because the market is higher, and maybe the sheeple will sell!

These bears can't say "I feel good, I feel great, I feel wonderful" when the market is going up, because then their bearish franchise value becomes diminished.

So they have to talk disaster or Armageddon; otherwise they have to admit they missed the entire rally. So instead of giving us reality, they give us poppycock and popcorn, because their analysis is all fluff, and the script they are touting is only real in their "reel" life!

He expects global stock markets to test their March lows, and probably worse. The slide could last three months. "A move to new lows is highly likely," he said.

This time he expects the S&P 500 index of US equities to reach the "mid 500s", almost halving from current levels near 1000. Such a fall would take London's FTSE 100 to around 2,500. The iTraxx Crossover index measuring spreads on low-grade European debt will double to 1250.

This is just stupid talk, but because it's from an intellectual with an agenda, it will get press, even though the chance of it happening is less than zero. Bob's sailing out on the high seas!

Remember four days before the rally started he said, "Be Safe, Be a Survivor, and and Be Liquid" and then he pontificated that China would fall to 1500, and then, as in now, he said the S&P would fall to 500.

So if you didn't know who "Hitler" was yelling at in the video below, who sold stocks at the bottom, you now may have a better idea.

And if you didn't know who the fools were that said that this was just a "bear market rally" you may, now again, have a better idea.

Now remember just a few weeks ago, before this latest rally, how we had other uber bears warning us that the market was going to puke? With their Depression era charts?

And how about a couple months ago on option expiration in June? Remember Charles Biderman of Trim Tabs? Saying we were going to roll-over and die? In June, at option expiration "their" super strategic and highly confidential reports that cost you money (and that's the only thing they do--is they cost you money!) said they were now fully bearish on US stocks. Now less than two weeks after the market bottomed, Charles Biderman said on March at option expiration that the rally could be over. Over!! And expiration in March was going to kill the rally! (And really do these flows really matter? Didn't we have $60B outflow before the bottom, and now we have $57 B inflow--but do these flows measure the shorts that have leaned on stocks?)

It would sure be nice, if someone had a record of that, wouldn't it? Oh that's right. We do. Right here, when it happened.

Biderman said the really was over in March and then over in June--so now it's time to trot out a fresh face! So now we have bearish Bob!

So what's the difference between Biderman and Bob? It's just the same story, dressed up and spun just a little differently, but the only difference is, they think they can average up, and spin their stories because the market is higher, and maybe the sheeple will sell!

These bears can't say "I feel good, I feel great, I feel wonderful" when the market is going up, because then their bearish franchise value becomes diminished.

So they have to talk disaster or Armageddon; otherwise they have to admit they missed the entire rally. So instead of giving us reality, they give us poppycock and popcorn, because their analysis is all fluff, and the script they are touting is only real in their "reel" life!

Another As Advertised!

AUGUST 2009: Doug Kass says markets are overshooting to the upside

"I believe that the markets are now overshooting to the upside and that the U.S. stock market has likely peaked for the year...

A double-dip outcome in 2010 represents my baseline expectation. When the stimulus provided by the public sector is finally abandoned, it seems unlikely to be replaced by meaningful strength or participation by any specific component of the private sector, and the burgeoning deficit (described above) will ultimately require a reversal of policy, leading to higher interest rates, rising marginal tax rates and a lower U.S. dollar. My forecast assumes that the market's focus will shortly shift from the productivity gains that have been yielding better-than-expected bottom-line results toward these chronic and secular worries."

-- Doug Kass, on August 26th, 2009

Dow: 9,543

Dow today: 11,97

So what was said here, and then, about Doug Kass and his call--and not 17 months later?

Wednesday, August 26, 2009

The Doug Kass "top" and bottom call

It really gets wearing calling these Wall Street folks to task, who keep finding cracks in the market, so I decided to read I Corinthians 13, before I wrote this story. Two weeks ago, Doug Kass made another bearish call. Today he amplified it, and said that the market may have made a top for the year, and he gave the following ten reasons:

- Cost cuts are a corporate lifeline and so is fiscal stimulus, but both have a defined and limited life.

- Cost cuts (exacerbated by wage deflation) pose an enduring threat to the consumer, which is still the most significant contributor to domestic growth.

- The consumer entered the current downcycle exposed and levered to the hilt, and net worths have been damaged and will need to be repaired through higher savings and lower consumption.

- The credit aftershock will continue to haunt the economy.

- The effect of the Fed's monetarist experiment and its impact on investing and spending still remain uncertain.

- While the housing market has stabilized, its recovery will be muted, and there are few growth drivers to replace the important role taken by the real estate markets in the prior upturn.

- Commercial real estate has only begun to enter a cyclical downturn.

- While the public works component of public policy is a stimulant, the impact might be more muted than is generally recognized. There may be less than meets the eye as most of the current fiscal policy initiatives represent transfer payments that have a negative multiplier and create work disincentives.

- Municipalities have historically provided economic stability -- no more.

- Federal, state and local taxes will be rising as the deficit must eventually be funded, and high-tax health and energy bills also loom.

But remember how Wall Street works. These macro calls are like the game "Who wants to be a millionaire." You get a Phone-a-Friend, an Ask-the-Audience, a Fifty-Fifty (50:50) and then three bad calls of your own.

A week before the market bottomed, Doug Kass got bullish, calling for a generational low. In mid April though, he sold out. And he got short.

On April 17, he was adding to his shorts and his SKF long and said this "Unlike my some of my bullish brethren on RealMoolah, I see blemishes in both Citigroup and General Electric's reports" and he said this "I added to my SPDRs and PowerShares QQQ shorts and my UltraShort Financials ProShares long in premarket trading."

Because the day before Kass said this:

Doug KassBuckle Up, Goose -- We're Going Short4/16/2009 4:39 PM EDTIn light of the fact that the S&P 500 has met my variant viewexpressed five weeks ago, Maverick is now engaging on the short side. I would caution getting too carried away with the market's strength -- which appears now to be the case.

I would say that Doug Kass has been way better than most on this rally, but he has used the "Who wants to be a millionaire" approach to market timing.

But since their were so few bulls at the bottom, and since Cramer needs Kass to sell subscriptions, his record is overstated.

So think about that, and his variant view of the market call today.

It ain't as cracked up as it looks!

Another As Advertised!

The Doug Kass "top" and bottom call

It really gets wearing calling these Wall Street folks to task, who keep finding cracks in the market, so I decided to read I Corinthians 13, before I wrote this story. Two weeks ago, Doug Kass made another bearish call. Today he amplified it, and said that the market may have made a top for the year, and he gave the following ten reasons:

- Cost cuts are a corporate lifeline and so is fiscal stimulus, but both have a defined and limited life.

- Cost cuts (exacerbated by wage deflation) pose an enduring threat to the consumer, which is still the most significant contributor to domestic growth.

- The consumer entered the current downcycle exposed and levered to the hilt, and net worths have been damaged and will need to be repaired through higher savings and lower consumption.

- The credit aftershock will continue to haunt the economy.

- The effect of the Fed's monetarist experiment and its impact on investing and spending still remain uncertain.

- While the housing market has stabilized, its recovery will be muted, and there are few growth drivers to replace the important role taken by the real estate markets in the prior upturn.

- Commercial real estate has only begun to enter a cyclical downturn.

- While the public works component of public policy is a stimulant, the impact might be more muted than is generally recognized. There may be less than meets the eye as most of the current fiscal policy initiatives represent transfer payments that have a negative multiplier and create work disincentives.

- Municipalities have historically provided economic stability -- no more.

- Federal, state and local taxes will be rising as the deficit must eventually be funded, and high-tax health and energy bills also loom.

But remember how Wall Street works. These macro calls are like the game "Who wants to be a millionaire." You get a Phone-a-Friend, an Ask-the-Audience, a Fifty-Fifty (50:50) and then three bad calls of your own.

A week before the market bottomed, Doug Kass got bullish, calling for a generational low. In mid April though, he sold out. And he got short.

On April 17, he was adding to his shorts and his SKF long and said this "Unlike my some of my bullish brethren on RealMoolah, I see blemishes in both Citigroup and General Electric's reports" and he said this "I added to my SPDRs and PowerShares QQQ shorts and my UltraShort Financials ProShares long in premarket trading."

Because the day before Kass said this:

Doug Kass

Buckle Up, Goose -- We're Going Short

4/16/2009 4:39 PM EDT

In light of the fact that the S&P 500 has met my variant viewexpressed five weeks ago, Maverick is now engaging on the short side. I would caution getting too carried away with the market's strength -- which appears now to be the case.

I would say that Doug Kass has been way better than most on this rally, but he has used the "Who wants to be a millionaire" approach to market timing.

But since their were so few bulls at the bottom, and since Cramer needs Kass to sell subscriptions, his record is overstated.

So think about that, and his variant view of the market call today.

It ain't as cracked up as it looks!

OCTOBER 2009: Robert Prechter says "stocks peaked in September"

"Stocks are very overvalued. Stocks peaked in September and are back in a bear market."

The S&P 500 will probably fall “substantially below” 676.53, the 12-year low reached on March 9, he said. His projection implies a drop of more than 34 percent from last week’s close of 1025.21. It rose to 1031.77 at 10:05 a.m. in New York.

-- Robert Prechter on Oct. 1, 2009

Dow: 9,509

Dow today: 11,971

Of course Prechter, last fall, did the same thing, when we had the pullback in the market--So we had this, here, and then about Prechter's bearishness:

Thursday, July 22, 2010

The bears picnic is over!!!

Oh My!! So we had a 140 point pullback in 5 minutes yesterday when Bernanke opened his mouth, and today we get it all back 5 minutes after the opening.

Oh My!!!

Big Deal. The HFT boys just stepped in. You can't handle the volitility? You want to whine? Then get the hell out of the market. The market doesn't need you and it doesn't need your money, and if you want to whine, the market will take what you have left.

Get some balls, get some conviction, and get long!!

I've never seen a market that is so hated by the bears--who can't get anything right, and can't see anything positive because they've been wired to be losers, because they haven't realized that life goes on without them, and the economy just doesn't give a sh*t about individual's own hardships.

Let's go back last month to this cover on Bloomberg Business Week. (You can read it here) Notice the title:

What can we learn? Nothing!!!

Prechter, in that article says "From a peak in 2010 the market should fall for six years!"

Roubini says, "...Everyone is delusional."

Nassim Taleb said, "The same analysis I made in 2006 holds stronger today...."

Meredith Whitney said "It's mathematically impossible to get a constructive jon growth scenario" "In fact, I am more bearish than I've been in a year."

Whatever. Another As Advertised!

Oh My!!!

Big Deal. The HFT boys just stepped in. You can't handle the volitility? You want to whine? Then get the hell out of the market. The market doesn't need you and it doesn't need your money, and if you want to whine, the market will take what you have left.

Get some balls, get some conviction, and get long!!

I've never seen a market that is so hated by the bears--who can't get anything right, and can't see anything positive because they've been wired to be losers, because they haven't realized that life goes on without them, and the economy just doesn't give a sh*t about individual's own hardships.

Let's go back last month to this cover on Bloomberg Business Week. (You can read it here) Notice the title:

GRRRRR!

What we can learn from the endless pessimism of Wall Street's biggest bears.

What can we learn? Nothing!!!

Prechter, in that article says "From a peak in 2010 the market should fall for six years!"

Roubini says, "...Everyone is delusional."

Nassim Taleb said, "The same analysis I made in 2006 holds stronger today...."

Meredith Whitney said "It's mathematically impossible to get a constructive jon growth scenario" "In fact, I am more bearish than I've been in a year."

Whatever. Another As Advertised!

OCTOBER 2009: Bill Gross says the rally is at its pinnacl

"Investors must recognize that if assets appreciate with nominal GDP, a 4%–5% return is about all they can expect even with abnormally low policy rates. Rage, rage, against this conclusion if you wish, but the six-month rally in risk assets—while still continuously supported by Fed and Treasury policymakers—is likely at its pinnacle. Out, out, brief candle."

"We're on a sugar high. It feels good for a while but it unsustainable."

"We're on a sugar high. It feels good for a while but it unsustainable."

-- Bill Gross on Oct. 27, 2009

Dow: 9,762

Dow today: 11,971

Thursday, October 29, 2009

The anatomy of the sell-off (conjob)

Monday we had wrong way Nouriel Roubini on CNBC warning the world of the catastrophe yet to happen.

Tuesday we had David "devil's advocate" Rosenberg on CNBC warning the world of the catastrophe yet to happen.

On Tuesday we also had these charts by Richard Russell being floated around the Internet, "proving" that the market was about to roll over.

(1) Too many distribution days.

(2) The bullish percentage of NYSE stocks in bullish trends is declining (see tomorrow's site).

(3) The percentage of NYSE stocks trading above their 50-day MA is declining (see tomorrow's site).

(4) The Transportation Average continues to decline (even on days when the Dow is up).

(5) The Dow is pressing against important resistance at 10,000. The S&P 500 is pressing against important resistance at 1100. The Nasdaq is pressing against important resistance at 2200. The big even numbers often represent stiff resistance.

Now Wednesday we have Bill "5,000 Dow" Gross of PIMPCO on CNBC telling us that stocks are hopelessly overpriced and that this time, his call of the top is right on the money.

Bill Gross does yoga to help him think. Maybe he should lighten up on the headstands, and walk on his feet, so he doesn't see the world upside down!

Bill Gross had John Hatzius from Goldman Sachs tag team him, who cut his estimate for Q3 GDP to 2.7%. Ooooooh. Goldman must "know" something!

It looks like they know something. They knew their prop desk was short and the stock prices had to come in! At least I advertised that here, and here!

And then, last night, Cramer went on Mad Money and said that "now the correction is here!" He forgot we were in real life, not reel life!

This morning, we see that SocGen came out with a piece that stocks were hopelessly overvalued, and that the stock drop could turn into a "rout!"

Oct. 29 (Bloomberg) -- The two-week retreat in global equities may turn into a “rout” after a measure of so-called leading indicators fell, signaling the economic recovery may be peaking, according to Societe Generale SA’s Albert Edwards.

Morgan Stanley chimed in and said "Stock Market 'Bubble' to End" with this piece:

Oct. 29 (Bloomberg) -- The global stock market rally, which resembles the bull run between 2003 and 2007, will end as government spending slows after so-called easy money boosted asset prices, according to Morgan Stanley.

And finally, to even suck in the depressed New Yorkers, whose Yankees got trounced by the Phillies, we saw this piece:

analysts of the game know Philadelphia’s triumph last night is the worst omen for the economy if history repeats itself.

Why? Because the Philadelphia Athletics went back-to-back in 1929 and 1930! And wasn't that the start of the Great Depression?

Maybe the analyst forget to tell Wall Street that Jimmy Fox's nickname was "The Beast." And isn't this the market of the beast?

So much for anecdotal evidence!

And finally, Cramer this morning tells the world that the $14 trillion US Economy would puke because SPW, a $2.6 billion dollar company, didn't have visibility, and also because Flowserve had downplayed future expectations last night!

Then the GDP printed at 3.5%. (btw who advertised 4% Q3 GDP in April when no-one said that was possible?--AS ADVERTISED!!!)

Right then, the entire bear thesis is OVER!

But Rick Santelli came on CNBC, and said that GDP figure was a backward looking indicator!

Thanks for the help boys! I covered my shorts at prices I never should of had!!!

And that's Wall Street's manipulations.

But the bears forgot, that Wall Street's chief pimp, Timmy Geithner was speaking before the hallowed halls of Congress, and he wanted prices higher. After all, his boss, needed to be on the airwaves touting the growth the Government bought!

So we had an orchestrated sell-off, to help the big boys who were short, and had it going against them.

If the stock market was wrestling, everyone would know it was phony.

But Wall Street dresses up their pimps, and trots them out on CNBC, and does their best to convince you, the move is real.

They want to slaughter you.

Which is why, I said the script changed.

And in a couple days, the same charts that were trotted out proving the market was ready to roll over, will be trotted out proving the market is ready to rally.

After it already rallies, of course!!

And after the bears, are once again, slaughtered!

Tuesday we had David "devil's advocate" Rosenberg on CNBC warning the world of the catastrophe yet to happen.

On Tuesday we also had these charts by Richard Russell being floated around the Internet, "proving" that the market was about to roll over.

(1) Too many distribution days.

(2) The bullish percentage of NYSE stocks in bullish trends is declining (see tomorrow's site).

(3) The percentage of NYSE stocks trading above their 50-day MA is declining (see tomorrow's site).

(4) The Transportation Average continues to decline (even on days when the Dow is up).

(5) The Dow is pressing against important resistance at 10,000. The S&P 500 is pressing against important resistance at 1100. The Nasdaq is pressing against important resistance at 2200. The big even numbers often represent stiff resistance.

Now Wednesday we have Bill "5,000 Dow" Gross of PIMPCO on CNBC telling us that stocks are hopelessly overpriced and that this time, his call of the top is right on the money.

Bill Gross does yoga to help him think. Maybe he should lighten up on the headstands, and walk on his feet, so he doesn't see the world upside down!

Bill Gross had John Hatzius from Goldman Sachs tag team him, who cut his estimate for Q3 GDP to 2.7%. Ooooooh. Goldman must "know" something!

It looks like they know something. They knew their prop desk was short and the stock prices had to come in! At least I advertised that here, and here!

And then, last night, Cramer went on Mad Money and said that "now the correction is here!" He forgot we were in real life, not reel life!

This morning, we see that SocGen came out with a piece that stocks were hopelessly overvalued, and that the stock drop could turn into a "rout!"

Oct. 29 (Bloomberg) -- The two-week retreat in global equities may turn into a “rout” after a measure of so-called leading indicators fell, signaling the economic recovery may be peaking, according to Societe Generale SA’s Albert Edwards.

Morgan Stanley chimed in and said "Stock Market 'Bubble' to End" with this piece:

Oct. 29 (Bloomberg) -- The global stock market rally, which resembles the bull run between 2003 and 2007, will end as government spending slows after so-called easy money boosted asset prices, according to Morgan Stanley.

And finally, to even suck in the depressed New Yorkers, whose Yankees got trounced by the Phillies, we saw this piece:

analysts of the game know Philadelphia’s triumph last night is the worst omen for the economy if history repeats itself.

Why? Because the Philadelphia Athletics went back-to-back in 1929 and 1930! And wasn't that the start of the Great Depression?

Maybe the analyst forget to tell Wall Street that Jimmy Fox's nickname was "The Beast." And isn't this the market of the beast?

So much for anecdotal evidence!

And finally, Cramer this morning tells the world that the $14 trillion US Economy would puke because SPW, a $2.6 billion dollar company, didn't have visibility, and also because Flowserve had downplayed future expectations last night!

Then the GDP printed at 3.5%. (btw who advertised 4% Q3 GDP in April when no-one said that was possible?--AS ADVERTISED!!!)

Right then, the entire bear thesis is OVER!

But Rick Santelli came on CNBC, and said that GDP figure was a backward looking indicator!

Thanks for the help boys! I covered my shorts at prices I never should of had!!!

And that's Wall Street's manipulations.

But the bears forgot, that Wall Street's chief pimp, Timmy Geithner was speaking before the hallowed halls of Congress, and he wanted prices higher. After all, his boss, needed to be on the airwaves touting the growth the Government bought!

So we had an orchestrated sell-off, to help the big boys who were short, and had it going against them.

If the stock market was wrestling, everyone would know it was phony.

But Wall Street dresses up their pimps, and trots them out on CNBC, and does their best to convince you, the move is real.

They want to slaughter you.

Which is why, I said the script changed.

And in a couple days, the same charts that were trotted out proving the market was ready to roll over, will be trotted out proving the market is ready to rally.

After it already rallies, of course!!

And after the bears, are once again, slaughtered!

Another As Advertised

And El-Erian's Sugar Highs? He's been pimping that for the last two years!

DECEMBER 2009: Mohamed El Erian says stocks will tank within one month

Claims: Stocks will drop 10 percent in the space of three or four weeks, bringing the Standard & Poor's 500 index below 1,000.

-- Mohamed El Erian on Dec. 28, 2009

Dow: 10,547

Dow today: 11,971

Monday, December 28, 2009

PIMCO's El-Erian comes back to his "sugar highs"----again

What else is new?

What do you do if you miss a 85% rally in the NAZ and a 65% rally in the S&P in nine months?

You blame it on sugar. As in "sugar highs!"

At 980-1010 on the S&P, El-Erian waxed about sugar highs. At 1040 he siad it was a brick wall, and then, we didn't have the "escape velocity" to break through. Now that we are above 1120, he ggoes back to "sugar highs" because PIMCO had already pimped McCulley in November saying that the economy was on a "slow slug." Now enough time has gone by for the attention-deficit sufferers on Wall Street, that they can trot out El-Erian with the same story that didn't work four months ago, and try it again. Sort of like the Doug Kass approach of calling the market top! But this time, the interview gets a front page in the LA Times, because maybe the folks in La-La land will still buy what he's pimping!

What do you do if you miss a 85% rally in the NAZ and a 65% rally in the S&P in nine months?

You blame it on sugar. As in "sugar highs!"

At 980-1010 on the S&P, El-Erian waxed about sugar highs. At 1040 he siad it was a brick wall, and then, we didn't have the "escape velocity" to break through. Now that we are above 1120, he ggoes back to "sugar highs" because PIMCO had already pimped McCulley in November saying that the economy was on a "slow slug." Now enough time has gone by for the attention-deficit sufferers on Wall Street, that they can trot out El-Erian with the same story that didn't work four months ago, and try it again. Sort of like the Doug Kass approach of calling the market top! But this time, the interview gets a front page in the LA Times, because maybe the folks in La-La land will still buy what he's pimping!

Another As Advertised!

And Rosenberg, Fleckenstein, Hussman, etc etc--and all you other bears? Well screw it--I have businesses to run!

Keep pontificating!

Subscribe to:

Posts (Atom)